Decline of the Dollar

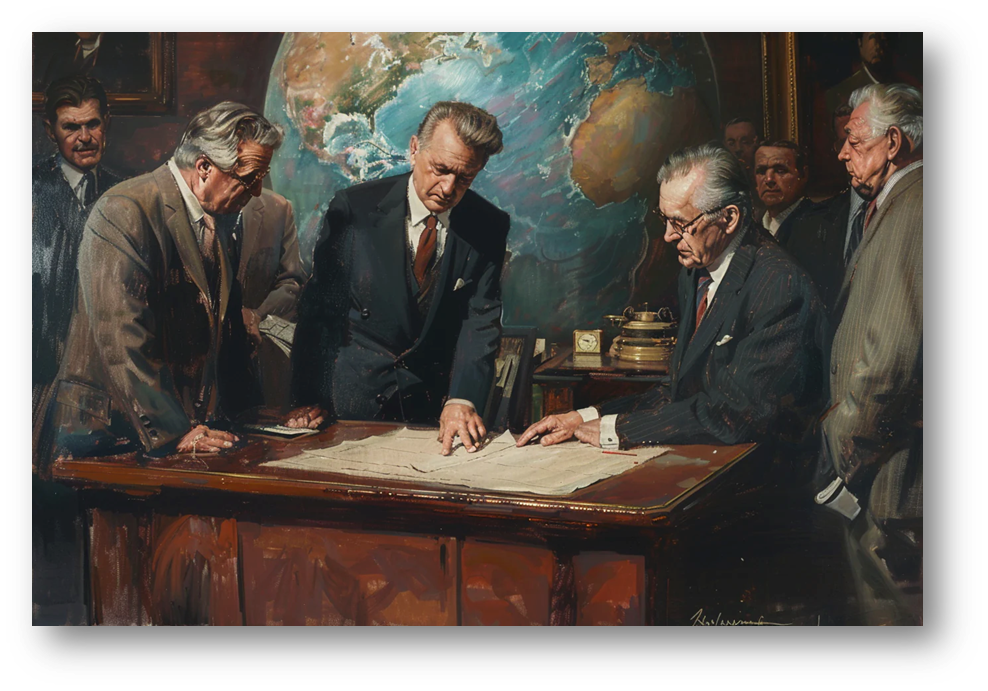

“The fact that many countries accept, as a principle, that the Dollar is as good as gold, leading Americans to get into debt for free, at the expense of the other countries because what the US owes them is paid with dollars, of which they are the only ones allowed to emit “

-President of France during 1960s-

This statement can be elucidated with greater clarity; therefore, give allowance to present a more detailed explanation…

- Dollar as Reserve Currency: The U.S. dollar is the most popular currency for global trade and is held by many countries as a ‘safe asset’.

- Debt and Trust: Because countries trust the dollar, they are willing to accept it for trade and debts. This makes it easier for the U.S. to borrow money.

- Debt for “Free”: The U.S. can accumulate debt without serious immediate effects because it can print more dollars to pay off what it owes. This allows the U.S. to borrow on better terms than other countries.

- Impact on Other Countries: This situation can hurt other countries. When the U.S. borrows more and pays back in dollars, it can lead to problems like inflation, affecting those countries that hold dollars.

- Exclusive Control: The U.S. is the only country that can issue dollars, giving it a unique advantage. This allows the U.S. to run deficits and carry large debts without facing immediate consequences as long as other countries continue to trust the dollar.

The Evolution of Currency: A Tale of Gold, War, and Transformation

Since the dawn of time, money has wielded an unparalleled influence over civilizations, but the modern saga of currencies took a dramatic turn in the 20th century, forever altering the world’s economic landscape. Let’s embark on a compelling journey through pivotal moments in the history of money to understand how we arrived at today’s fiat currencies.

The Gold Bastion: From the 1800s to Conflict

Imagine the world during 1873, when Germany boldly embraced the classical gold standard. Each unit of currency had a tangible piece of gold backing it up. Everything was straightforward, and the idea of paper notes representing real wealth was solidified in the minds of both citizens and governments alike.

Fast forward to the harrowing days of World War I; as nations plunged into chaos, banks began to flounder under the weight of war’s financial demands. Redemption rights—once the supporter of trust—were abruptly halted. The metallic clang of gold bars was silenced. This era marked a turning point where governments resorted to quantitative easing which means more currency-printing, an unorthodox strategy that began to shake the foundations of traditional monetary practice.

The Dawning of a New Era

As the war raged on, the United States, true to its bad-boy character, stayed on the sidelines before finally entering the fray, only in the last six months of WWI. The American economy emerged not only relatively untouched but profiting from the war—after all, they were paid in gold for the supplies shipped to Europe, transforming the nation into a financial powerhouse. This was the reason which gave America its courage to become the world’s super power.

When the dust settled after World War II, the U.S. found itself in a unique position, holding a staggering two-thirds of the world’s monetary gold. The remaining gold was scattered like treasures among other nations, setting the stage for the Bretton Woods system.

Here, most of the world’s currencies were tied directly to the U.S. dollar, which in turn was linked to gold, creating an interdependence that was both fragile and powerful.

Deficits and Declines

Yet the post-war economic boom came with its own set of challenges. As countries raced to rebuild, the allure of deficit spending became tempting. Nations found themselves in a paradox: while the economy grew, so did their debts, leading to increased borrowing and spending far beyond the means of their gold reserves. This would set the stage for pivotal changes in monetary policy.

The United States, under President Nixon, would soon embark on a radical departure from the past. On August 15, 1971, the unthinkable happened: Nixon severed the gold standard, unmooring the U.S. dollar from its golden anchor. With this act, most of the world currencies transitioned into fiat money, a system not backed by physical commodities but by the trust and authority of national governments.

The Financial Future

“We are the nation’s dollars, a vibrant parade,

The greatest treasure ever forged, unafraid.

Once we danced in millions, a harmonious throng,

Now we rise in billions, resolute and strong.

In time, we may reach for the stars of trillions,

Before you slip softly into time’s quiet millions.”

Now, we live in a world awash with fiat currencies, driven by quantitative easing as a primary monetary tool, where central banks can inject liquidity into economies, aiming to stave off recessions and stimulate growth. Yet, the shadows of gold glimmer faintly in the backdrop, a reminder of the past, as today’s financial landscapes wrestle with inflation, deflation, and economic uncertainty.

We now understand how the historical upheavals shaped contemporary finance. The shift from tangible gold to abstract value brings forth exciting possibilities but challenges us to ponder: what is the real value of our money in a world where trust reigns supreme over tangible assets? The evolution of currency is but a chapter in humanity’s ongoing journey toward understanding the nature of wealth and value.

What’s going on recently?

In 2023, a wave of countries turned to the yuan, signaling a potential shift away from the dollar’s dominance in global trade. Argentina aimed to conserve U.S. dollars by importing from China with an increased swap line of 18 billion yuan. Brazil and China kicked off trade in local currencies, inspiring ASEAN nations to consider similar moves, while Bolivia opted for the yuan to address dollar liquidity challenges.

Saudi Arabia explored yuan transactions for oil, alongside discussions on barter trading gold for oil, reflecting a creative economic strategy. India worked to stabilize its currency through reduced dollar dependence, and Iran leveraged various currencies and blockchain tech to sidestep sanctions.

Malaysia eyed a transition away from the dollar in its trade with China, while Turkey sought local currencies for transactions with both China and Iran. Saudi Arabia remained open to trading in currencies beyond the dollar, especially with BRICS nations. Notably, Venezuela has been pricing its oil in euros and yuan since 2018, exemplifying this trend. This collective movement highlights a growing desire among nations for greater financial independence in a multipolar world.

Forex Reserves: U.S. dollars in global foreign exchange reserves dropped from 71% in 1999 to 59% in 2021, indicating de-dollarization.

Governments and central banks have repeatedly reshaped our currency systems, often benefiting themselves while leaving the public at a disadvantage. Each new system seems designed by the same players—big banks and state authorities—who profit at the expense of everyday people. But is there a way out of this cycle? Yes! By returning to gold and silver, we can reclaim financial stability and prevent governments from transferring wealth from the populace to themselves and the banks. It’s time to restore value and trust in our money!